Shiny Real Estate and how it effects the future.

Published on: Wednesday, September 23rd, 2015

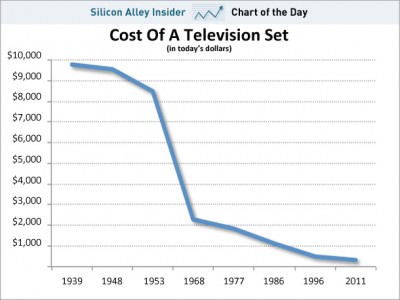

If you are buying the newest, shiniest technological advancement you know you’re paying a premium for it. It’s the way it works. For instance, a 20″ flat screen television in 1999 cost $1,200 and today you can get it for $84. And it is interesting to note that during that same timeframe the size of televisions has grown 800%.

And it is interesting to note that during that same timeframe the size of televisions has grown 800%.

The residential rental market works the same way. In the Omaha market construction has been remarkable. The new units that have been brought on board has steadily increased the past few years peaking at 1,650 permits in 2015. This year the number has, year-to-date reduced by 58% (OWH). But, in our meetings at the City of Omaha’s Zoning Board of Appeals we’ve seen new projects coming online that will add nearly 600 more units to the market. And this does not include properties that have been recapitalized.

Regardless, if we take the numbers at face value it looks like we can predict that the slowdown has begun, and even if we assume the other 600 will be ‘permited’ this year one thing is for sure, class A properties will saturate their market. And no doubt, the apartments that have been recently been brought online and that are coming online are fantastic in that they are bringing many higher end professionals to what had been dilapidating parts of town. They have brought a new vigor to the areas and given otherwise home buyers a great place to live without the hassles of ownership.

And where technology is quickly backfilled with cheaper higher quality versions of itself on a micro scale real property manifests itself at a macro level. In other words technology changes at the unit level and residential apartments change at the market level. The main reason, of course, is because apartments are not easily changed. Once you construct at A property the investor will have outlayed about $80k-$110k per unit, that material and labor cost is fixed. Instead what happens is the vivacious area built by the latest and greatest places to live is now attractive to everyone, including people that can’t afford the A class living. Service industry employees need a place to live and the businesses serving these new population centers need people to hire. A demand is created and the backfill is churned out in rehabilitated units. Living quarters that are nice enough in and of themselves, but that are, more importantly, in the convenient and fun parts of town.

The play, as it were, for investors to the Omaha market will be in taking the remaining edifices that until recent years served a C class tenant and turning them into B class residences. The dilapidated areas of town are still not all brand new and shiny. The A class properties are peppered in the area enough that they have made a difference, but the transformation is not complete. Because the outlay for B properties is substantially less than doing a full blown remodel or new build it may well be feasible to operate these units at about $60k-$70k per unit. The ‘lipstick and rouge’ approach is far less sexy, but it is safer in an area that is saturated with A class properties.

Our prediction for the midtown market is that upward pressure will be applied to these units and the investor having brought them to a higher quality product will have good and a more stable real estate portfolio in the next couple of years. We all remember the crash of the market in 2008 and these buildings will be in a better position to weather and dips a stalling economy might bring. But even without a dip they will be exposed to a growing market as more demand is applied to the market of people looking to live a more midtown lifestyle.